Contents

The Fibonacci levels of retracement are 23.6%, 38.2%, 61.8%, and 78.6%. For example, some day traders buy the stock when 3 MA crosses 5 MA or when 5 MA crosses 8 MA, or when price crosses above either MAs, and vice versa for shorts. Going forward, for a sustained upward move, the stock has to surpass 50 per cent and then 61.8 per cent resistance levels convincingly. Let’s apply the Fibonacci retracements, when the stock started falling in order to identify levels up to which it can bounce back. The chart above illustrates Fibonacci trading from the Russell Emini futures 10 minute chart. In the forgoing projection example, B was retraced to .62 of XA and then a projection of 1.27 to 1.62 of XA swing is expected.

The trades are either initiated or closed at these confluence levels. The Fibonacci series was discovered in the 12th century by an Italian mathematician named Leonardo Pisano Bogollo, otherwise known to his friend as Fibonacci. Using the same series and its relationship with almost everything, the method of Fibonacci Retracement was created to find the support and resistance level.

No one knows why Fibonacci retracements work so well with uncanny accuracy. Just like the presence of the Fibonacci sequence and its golden ratio in nature is majestic, it works magic in the stock market. In trading, whenever stocks move up or down, somewhat sharply, they tend to retrace their steps before any more moves are made.

However, it is wise to use the Fibonacci Retracement in conjunction with other technical indicators. Fibonacci retracements levels don’t provide any assurance for the prices to bounce back at any level. Fibonacci retracements are often used to make the low-risk entries in the existing strong trend by identifying the pullback and the support level.

The indicator has different levels that show the possibility of bouncing back, it is up to the traders to best anticipate the bounce back retracement level for entry. In any market , the corrections usually end near golden ratio or one of the other Fib retracement levels. 2) The ratio of successive Fibonacci numbers is called the https://1investing.in/ “golden ratio”. Let A and B be the two consecutive numbers in the Fibonacci sequence. To find any term in the Fibonacci sequence, we could apply the above-said formula. This is to inform that, many instances were reported by general public where fraudsters are cheating general public by misusing our brand name Motilal Oswal.

Fibonacci Trading

Typical traders have come across the word, ‘Fibonacci’ in the trading universe more times than they care to mention. You will even find stock market analysts on television suggesting that stocks are trading close to Fibonacci levels. Stock charts that traders analyse and examine to determine the feasibility of trading in the stock often contain Fibonacci ratio applications.

“The ratio of one number divided by the next settles at .618, which is known as the golden ratio. In nature, this is the proportion of a perfect spiral, like that found in a pinecone and a pineapple. This ratio has in turn been correlated to stock price action and enacts retracements and target levels periodically,” Nikhil Kamath, Co-Founder & Director, Zerodha, told ETMarkets.com. Finally, since a stock’s S & R values do not depend on the Fibonacci retracement values, they should never be the sole parameters taken into account by technical traders. At best, if the S & R values have a recognisable candlestick pattern, they can be taken as a determining value for a stock. The wise stockbroker and trader will take into account other, seemingly extraneous, factors too before making a move.

In the real world, the use of this tool is rather restricted, but there is ample scope for future technical trading. The Fibonacci Retracement is used to identify the level at which the stock will retrace before moving in the opposite direction. These levels allow investors to identify resistance levels, draw support lines, put stop-loss orders and set a target price for the stock.

No calculation is required because there is no method for determining the Fibonacci retracement levels. A Fibonacci retracement calculation is nothing more than a simple reference to the percentages of the price range being considered. The ratios 2.618 and 0.382 correspond to percentage levels of 261.8% and 38.2%, respectively, translating to a corresponding increase of 161.8% and a decrease of 61.8%. Thus, each successive term in the sequence is 2.618 times, or 161.8% greater than, its 2nd predecessor. And each term is 0.382 times or 38.2% of its 2nd successor, in other words 61.8% smaller than it. The ratios 1.618 and 0.618 correspond to percentage levels of 161.8% and 61.8%, respectively, translating to a corresponding increase of 61.8% and a decrease of 38.2%.

What exactly is a Fibonacci Arc and how is it applied in technical charting and trading decisions?

Hence those who trade using Fibonacci ratios would prefer to place their entry or exit when the stock’s performance is at a key Fibonacci ratio. Those employing Fibonacci retracement will expect volatility around this time, which could work in their favor. A Fibonacci retracement is used to recognize key support or resistance levels in a stock’s performance by using Fibonacci ratios. In descending order, these ratios are 100%, 61.8%, 38.2%, and 23.6%. While 100% and 50% are not Fibonacci ratios, they are also used to create the retracement. Fibonacci Extension refers to the market moving with the primary trend into an area of support and resistance at key Fibonacci levels where target profit is measured.

We at Enrich Money do not provide any stock tips to our customers nor have we authorised anyone to trade on behalf of others. If you come across any individual or organisation claiming to be part of Enrich Money and providing such services, kindly intimate us immediately. Each number equals the sum of the two numbers before it and is around 1.618 times greater than the earlier one. The Fibonacci sequence is a series of numbers, where a number is found by adding up two numbers before it. Starting with 0 and 1, the sequence goes 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, and so on and so forth till infinity.

The Perfect Ratio for Trading

However, the use of Fibonacci Retracement is subjective and has been known to make profits for some investors and losses for others. As there is no logical proof behind the effectiveness of the Fibonacci Retracement to evaluate stocks, there is no saying if it can work for a particular investment strategy. Furthermore, the Fibonacci Retracement can only signal towards a price correction, countertrend bounces and reversals without any strong or weak signals towards the price movements. 2,4,16,256, ….., …… This is what Fibonacci Retracement is all about.

The setting of marketing and trade trends using Fibonacci retracements and Fibonacci ratios. In this Fibonacci spiral, every two consecutive terms of the Fibonacci sequence represent the length and width of a rectangle. Let us calculate the ratio of every two successive terms of the Fibonacci sequence and see how they form the golden ratio. The Fibonacci sequence is represented as the spiral shown below.

- They can make orders, define stop-loss levels, and create price goals with the information.

- Fibonacci ratios i.e. 61.8%, 38.2%, and 23.6% can help a trader identify the possible extent of retracement.

- Fibonacci series The Flush technique reveals hidden levels of support and resistance that may be used for entry, exit, and stop placement.

- Furthermore, the Fibonacci Retracement can only signal towards a price correction, countertrend bounces and reversals without any strong or weak signals towards the price movements.

- Fibonacci is a lot more about mathematical patterns and less about chart patterns.

The effectiveness and power of Fibonacci retracement are multiplied when combined with other technical indicators. A trader can use the volatility of the market to his/her advantage and make healthy financial gains with the help of this technical tool by identifying appropriate buy and sell signals. Further, this tool can be applied better when the long-term trend is identified first and one is confident about the bounce back. Fibonacci fans are consisting of three diagonal lines that use Fibonacci ratios to help identify key levels of support and resistance. In the chart below on SENSEX, Fan-Lines have worked as decent supports in 2011. It is this natural presence of Fibonacci series which attracted technical analysts’ attention.

What is The Fibonacci Sequence in Nature?

Fibonacci retracement levels are horizontal lines showing potential support and resistance areas. Fibonacci Retracement can be applied to almost any trading instrument and is relatively simpler when compared to other technical indicators. Call Loan Rate Definition This makes Fibonacci Retracement one of the most widely used indicators by investors to evaluate and analyse stocks. Investors apply the Fibonacci Retracement method when they witness a stock showcasing high volatility.

After all, collective human behaviour may also be considered as a natural phenomenon and should probably follow the same mathematical behaviour. The first level to watch out would be 61.8 per cent, which provided a strong support for the stock in the past. The stock chart shows that it had bounced back from that level seven times in the past. Hence, a break below that level fuelled further downside in the stock and it went on declining towards 23.6 per cent retracement before moving higher.

Hence, Fibonacci numbers can help traders to use specific levels to position themselves while trading. If you want to enter trading and be a success, first you have to open a demat account with a proficient broker like Motilal Oswal. Then, you can learn more about different techniques of analysis and tactics to help you in your trading endeavours. The Fibonacci Retracement proves to be an effective way for investors to draw the support lines and identify the resistance levels.

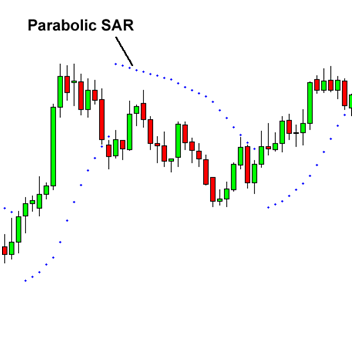

Applied on SENSEX it suggests first key support on any correction in the index should be around (23.6% Fibonacci retracement of rally since Feb-lows). The Fibonacci technical analysis employs the work of Italian mathematician Leonardo de Pisa to anticipate stock trends and price movement. The Parabola Pop technique monitors breakouts above and below retracement levels to determine entry points for significant breakouts and falls. Fibonacci series The Flush technique reveals hidden levels of support and resistance that may be used for entry, exit, and stop placement.

What is the Formula for the nth Term of The Fibonacci Sequence?

Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express writtern permission of moneycontrol.com is prohibited. Leonardo Fibonacci, an Italian mathematician, is credited for introducing Fibonacci sequence in his book . However Virahanka’s work in 700 AD seems to have discussed the series pretty clearly. Do not share of trading credentials – login id & passwords including OTP’s. Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month.

Typically, this phenomenon is plotted on daily, weekly, and monthly charts. Engulfing twins in a candlestick pattern is a very effective confirmation of the Fibonacci retracement level. The chances of bounce back or reversal are high when Fibonacci levels confluence with these technical analysis indicators.

Fibonacci is a lot more about mathematical patterns and less about chart patterns. In fact, Fibonacci extrapolates these mathematical patterns into the price chart and takes it forward. Fibonacci levels are an extremely popular technical analysis tool. While the concept is quite empirically sophisticated, its application is not all that difficult. In fact, Fibonacci was a 12th-century mathematician in Italy who developed a series of ratios that is very popular with technical traders.